Clarifying to See Better

A stupid analogy because I cannot think of a better one right now is that when you first heat butter it is milky looking and then starts to bubble and until the bubbling stops you cannot see the bottom of the pan. This morning I saw the bottom of a couple pans.

The first one was thanks to a post over on Naked Capitalism where Yves Smith writes about one of the Right's favorite boobs and the left's Economic policy leader, Paul Krugman. The really interesting part of this post was the distinction between fiscal and monetary policy. Basically, Krugman and Summers argue in a NY Times article, for a couple things: First that since it is impossible to balance government spending we must inflate our way out of the budgetary mess we are in, and; Second, since there is no Real economic growth at this time, it makes sense to create economic bubbles. You should read the NY Times article Secular Stagnation, Coalmines, Bubbles, and Larry Summers so you know I did not make this up.

Back to fiscal vs monetary policy, once I understood how fiscal policy like running government deficits is the real culprit because it is trying to create economic growth through debt creation, which seems to be the only tool in the bag of policy-makers, then the current economic conditions around the world make more sense. Every government in the world seems to be creating debt though deficit spending (fiscal policy) and debasing their currency through central bank low interest rates (monetary policy). Makes me want to see if there is one western-style government not embarking on that path. Even the Swiss are debasing their currency now! The result of generating inflation is that individuals are the ones paying for this in reduced purchasing power. From Yves Smith.....

The other distinction is Nation and State. And, why this is important became clear today when trying to understand why governments will not reign in deficit spending for one thing. The concept can be applied to many other government policies that do nothing for the common person except make their lives worse. Over at Golem XIV in an article by David Malone he helps us understand the difference between Nation and State.

The first one was thanks to a post over on Naked Capitalism where Yves Smith writes about one of the Right's favorite boobs and the left's Economic policy leader, Paul Krugman. The really interesting part of this post was the distinction between fiscal and monetary policy. Basically, Krugman and Summers argue in a NY Times article, for a couple things: First that since it is impossible to balance government spending we must inflate our way out of the budgetary mess we are in, and; Second, since there is no Real economic growth at this time, it makes sense to create economic bubbles. You should read the NY Times article Secular Stagnation, Coalmines, Bubbles, and Larry Summers so you know I did not make this up.

Back to fiscal vs monetary policy, once I understood how fiscal policy like running government deficits is the real culprit because it is trying to create economic growth through debt creation, which seems to be the only tool in the bag of policy-makers, then the current economic conditions around the world make more sense. Every government in the world seems to be creating debt though deficit spending (fiscal policy) and debasing their currency through central bank low interest rates (monetary policy). Makes me want to see if there is one western-style government not embarking on that path. Even the Swiss are debasing their currency now! The result of generating inflation is that individuals are the ones paying for this in reduced purchasing power. From Yves Smith.....

If you want to put it in more technical terms, what is happening is a large and sustained fall in what Keynes called the marginal efficiency of capital. Companies are not reinvesting at a sufficient rate to sustain growth, let alone reduce unemployment. Rob Parenteau and I discussed the drivers of this phenomenon in a New York Times op-ed on the corporate savings glut last year: that managers and investors have short term incentives, and financial reform has done nothing to reverse them. Add to that that in a balance sheet recession, the private sector (both households and businesses) want to reduce debt, which is tantamount to saving. Lowering interest rates is not going to change that behavior. And if you try to generate inflation in this scenario, when individuals and companies are feeling stresses, all you do is reduce their real spending (and savings power) and further reduce demand (and hence economic activity).Steve Blumenthal came to the same conclusion in his weekly update. This sounds like the totally discredited trickle-down economic theory in different clothes. If you cannot do it politically with even lower taxes on the rich, then do it a different way with monetary policy.

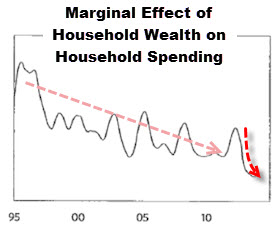

“As shown in the charts below, the marginal effects of wealth increases on economic activity have been declining significantly. The Fed’s dilemma is that its policy is creating a financial market bubble that is large relative to the pickup in the economy that it is producing. If it were targeting asset prices, it would tighten monetary policy to curtail the emerging bubble, whereas if it were targeting economic conditions, it would have a slight easing bias. In other words, 1) the Fed is faced with a difficult choice, and 2) it is losing its effectiveness.And, John Maudlin in a promotional article of his new book writes about this in a similar vein. John writes:

The basic issue is that quantitative easing is a much less effective tool when asset prices are high and thus have low expected returns than it is for managing financial crises. That’s because QE stimulates the economy by (1) offsetting a panic by providing cash to the financial system when there’s a need for cash, and (2) by raising asset prices, and driving money from the assets they buy into demand and investment, creating a higher level of future economic activity. So, the policy was particularly wise and most effective (in the sense of impact per dollar) at the height of the financial crisis when there was both a desperate need for cash and when extremely depressed asset prices were heavily weighing on demand and investment.

This concept is key to understanding current economic thinking. The belief is that it is demand that is the issue and that lower rates will stimulate increased demand (consumption), presumably by making loans cheaper for businesses and consumers. More leverage is needed! But current policy apparently fails to grasp that the problem is not the lack of consumption: it is the lack of income. Income is produced by productivity. When leverage increases productivity, that is good; but when it is used simply to purchase goods for current consumption, it merely brings future consumption forward. Debt incurred and spent today is future consumption denied.So the Fed policy of loose money comes around at this point to destroy demand from consumers. While TARP may have been necessary at one point, clearly it is not helping now except to kick the can down the road through once again trying to increase debt in all sectors: individual, corporate and government. That seems to be the only economic tool policy makers will use.

Simply put, ultra-low interest rates mean that those who have saved money in whatever form will be getting less return on that money from safe, fixed-income investments. We're talking about rather large sums of money, as we will see. Ironically, this translates into a loss of consumption power when the Federal Reserve is supposedly concerned about consumption and requires increased savings at a time when the Fed is trying to boost demand. This is robbing Peter to favor an already well-off Paul.Hope readers got the distinction between fiscal and monetary policy and why it is so important to understand the differences. If we only use monetary policy the result will be the loss of consumption and less demand. The only ones who win are financial institutions and already wealthy individuals. The rest lose because they are getting less return on safe fixed-income investments and inflation and the resultant decreased purchasing power hurts demand and makes most people poorer. And, the large sums of money Maudlin talks about - Pension Plans! Got one? Be concerned.

The other distinction is Nation and State. And, why this is important became clear today when trying to understand why governments will not reign in deficit spending for one thing. The concept can be applied to many other government policies that do nothing for the common person except make their lives worse. Over at Golem XIV in an article by David Malone he helps us understand the difference between Nation and State.

Our problem and their advantage is that it is deeply ingrained in us to see the State and the Nation as almost interchangeable. The very name, ‘The Nation State’ inclines us to believe that the State and Nation are one and therefore that any action taken by the State, no matter how harsh or unfair it might seem to us, must necessarily be for our good. It allows those who control the State to hide their narrow selfish interests behind a smokescreen of talk about the Nation.David uses the example of the EU-US Trade talks portrayed in the media as a battle ground for governments to advance the interests of their citizenry. Who does it really help?

They, with the help of a largely supine and grovelling media, will claim to be there for you. They will be decked out in flags and called by the names of our nations or national groupings, such as the EU. But the truth will be otherwise. Behind the national name plate a largely unseen machinery will be almost entirely corporate. Both sides will be there to seek advantage, not for you the people, not for the nations whose flags they use as camouflage , but for the corporations who pay them. The US delegation will seek advantage for US based global corporations and the EU delegation will seek advantage for EU based global corporations. Both sides will be hailed victorious. The real question – very carefully never ever raised by the compliant media will be - who lost? And the answer, studiously unreported, will be the ordinary people of both sides.Then he argues who does the NSA (US) and GCHQ (British) really work for? Is it The Nation as we are led to believe? Using Snowden's disclosures as an example.

But is it really National Security Mr Snowden compromised or State Security? When someone appeals to ‘National Security’ the unspoken assumption is that they are talking about your security and mine. We, after all, are ‘the Nation’. But I wonder if Mr Snowden might be more accurately described as having compromised the State’s security rather than the Nation’s. Which doesn’t sound nearly as good, does it? State security has a ring of the Stasi about it. And for good reason. Protecting the interests and security of the State is quite different from protecting the interests of the people who make up the Nation. One is about protecting you and me. The other is more about protecting the position, power and wealth of those who make up the State and its various organs of power. State security is about the security of the jobs and social postion of those who are ‘the State’. It is about the security of a particuar arrangement of power and those who benefit from that arrangement. Which one does the NSA or GCHQ serve? Which did Mr Snowden really compromise by revealing the extent of the NSA’s and GCHQ’s indiscriminate and unlawful spying upon ordinary and innocent citizens?Mr Malone challenges us to prove that the persecution of Snowden really helps the Nation. Our elected representatives are almost completely divorced from the internal running of the NSA and GCHQ. So, who do the NSA and GCHQ work for?

If we wish to hold on to the fiction that the NSA and GCHQ work for their respective Nations then how do we explain that the people we elect, even very senior members of the State, even within the government of the day, had NO idea what the NSA or GCHQ were doing? Certainly the NSA and GCHQ were financed by us, and draw their original legitimacy from us, but they no longer answer to those who we elect. So who do they answer to? To what are they loyal and to whom do they report?And, here is why I have been thinking, writing, and communicating that the divisions between Pubs and Dems, liberals and conservatives, and Left vs Right are all artificial divisions to keep the voting public angry at the wrong supposed enemy and completely in the dark about the reality of the situation. This situation has been clear to me for sometime. I really like the way Mr Malone lays it out in the next section.

The old order was laid out from left to right: Communist to Libertarian. From those who felt the State was there to guarantee certain protections and provide a minimum of welfare and service, over to those who felt any intervention from the State was no more than an abuse of power by a group of self serving insiders. Largely this is still the range of thought and opinion. Those on the Left see the Free Market as the greatest danger to liberty, welfare, justice and fairness, and regard the State as our best protection against it. While on the Right the fears are exactly the same but the State is now the great danger and the market the best protection. Each side regards the other as hopelessly, even criminally, misguided. Each side sees the other advocating that which will bring disaster.

Into this sterile and suffocating tweedledumness a new ideology and power has grown. It is neither Libertarian nor Left, but has been called both. The Libertarians have seen how eagerly and constantly this new politics intervenes in and distorts the market and cries “Socialism”. Which, it has to be said, makes anyone who knows anything about Socialism gasp with amazement. Nevertheless you can read this ‘it’s socialism’ opinion in most of the right wing press and on most blogs where Libertarians comment, such as ZeroHedge or The Ticker.

On the other hand the Left sees the way the new politics intervenes on behalf of and protects the interests of the wealthy (The financial class and global corporations) doing nothing about tax avoidance, nothing to regulate the banks, insisting instead that the only answer is more free market, less regulation and austerity to be borne by those least able to bear it – and sees clear evidence that this new politics is right wing and libertarian.

Both sides seems only able to see things in terms of the labels and world view they are used to and as a consequence see nearly nothing at all. The truth, I suggest, is that we are at a moment when an entire cultural form is ending. At such times it is not one part or another, government or market, which corrupts and breaks, which betrays the values it was meant to embody and ceases to do the job for which it was created, it is all parts at once. All parts of our society have become corrupted.

We must move beyond the politics of the last century, seeking to blame all ills on a corrupt and captured State or alternatively on a corrupt, captured and rigged market. BOTH are true. Both are corrupt. Neither is working for us. A new elite exists in every nation, has control over every State but which has no loyalty to the Nation of people in which it exists any more than a tape worm is loyal to the creature in whose body it feeds and grows.Nation vs State and Fiscal vs Monetary Policy. Understand how these distinctly different concepts are affecting us in very real ways. The general media, political and economic pundits, and politicians confuse the differences and keep us mad at artificial divisions like Pub/Dem, Left/Right, Conservative/Liberal instead of the real culprits who create and continue the problems the average person face.

Comments